Japanese inflation stays high as BOJ meeting gets closer

Latest data shows Japanʼs core prices remain above central bankʼs target with service costs going up. BOJ might change its policy next month as yen stays weak and wages keep rising

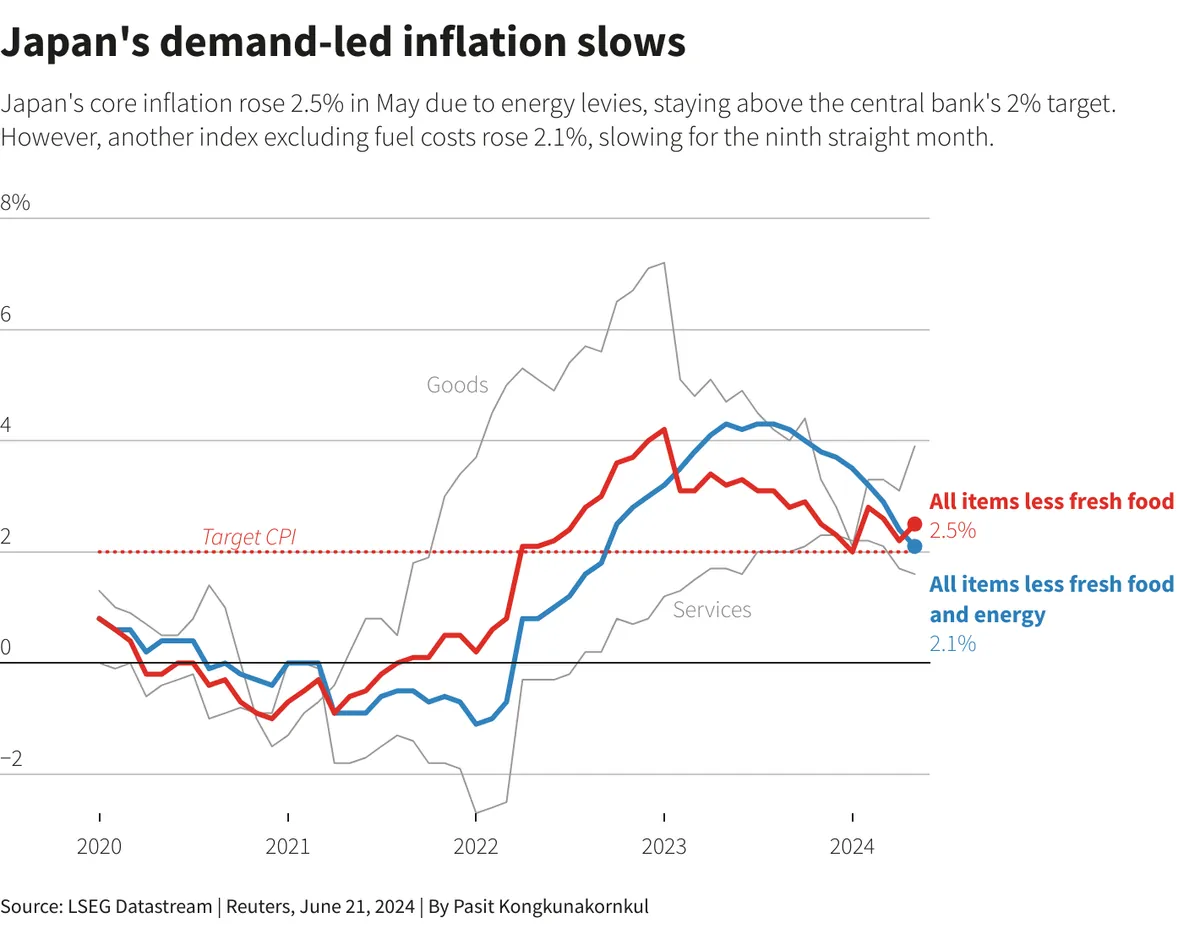

Japans core prices stayed above target in Oct-2024‚ with a 2.3% yearly rise (higher than market guesses of 2.2%) The index that doesnt count fuel costs also went up by 2.3%‚ showing wider price changes in the economy

Service costs jumped to 1.5% from last months 1.3% — a sign that companies are passing higher worker pay to customers. The data comes as Kazuo Ueda and the BOJ team get ready for their Dec meeting‚ where they might push rates from 0.25% to 0.5%

Rice costs shot up by 58.9% making food very costly (which isnt good for shoppers); this adds to the mix of things the BOJ needs to think about. Factory work dropped for 5 months in a row because Chinese buyers arent ordering as much

- March: BOJ stopped negative rates

- July: First rate increase to 0.25%

- December: Maybe another rise coming

The yens recent drop is making imports cost more which adds to price rises. Ueda said theyʼll look at lots of info before the Dec 18-19 meeting: this made markets think a rate change might happen soon

We will examine a vast amount of data and information before the meeting

A poll done in early fall showed most money experts think the BOJ will wait till next year to change rates‚ but new data might make them change their minds