• Recalls similarities with Commodore Computers

• Blasts Opposition on ‘brownie points’: ‘Must unite’

• Pintard: Criticism ‘off-base’; we’re filling a vaccum

By NEIL HARTNELL

Tribune Business Editor

nhartnell@tribunemedia.net

A well-known businessman yesterday urged the Bahamas to “stand united” in the face of FTX’s implosion as he blasted the Opposition’s leader for trying to “score cheap political brownie points” over the affair.

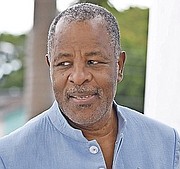

Sir Franklyn Wilson, the Arawak Homes and Sunshine Holdings chairman, told Tribune Business that some of Michael Pintard’s comments were “worthy of condemnation” as he warned that a divided political leadership will make it much harder for The Bahamas to withstand international criticism over the crypto exchange’s failure.

Arguing that the Free National Movement (FNM) leader was effectively now shunning a digital assets regulatory regime that was passed, and implemented, by an administration in which he was a Cabinet minister, Sir Franklyn said FTX was not The Bahamas’ “first rodeo” when it came to high-profile cross-border corporate failures on an international scale.

Recalling his appointment as liquidator for Commodore Computers, which in the 1980s and early 1990s was arguably that industry’s biggest name, Sir Franklyn said himself and his attorney, the late Paul Adderley, were able to reach an agreement with US creditors over how the company was to be wound-up.

Noting that FTX’s Bahamian court-appointed provisional liquidators face the same situation today, namely competition for control and assets with the group’s US-appointed chief executive and Chapter 11 bankruptcy process, he added that this nation must ensure the outside world sees only “competence” from its judges, attorneys and regulators in how the crypto exchange’s fate is dealt with moving forward.

This, Sir Franklyn said, will be critical to protecting The Bahamas’ integrity and good name which is now “at risk”. Acknowledging that “there’s no doubt this has hurt us”, he added that the country must also “defend our laws” which have come under external attack after the Securities Commission obtained a Supreme Court Order to protect digital assets under the Bahamian FTX subsidiary’s control by having them transferred to “wallet” under its control.

Mr Pintard, though, last night hit back “in the strongest terms” at Sir Franklyn’s comments by describing them as “off base”. He added that both himself and the Opposition have been “measured” in their public comments on FTX, and said they had sought to fill the “vacuum” created by the Government’s relative silence on the affair through “aggressively” defending The Bahamas and its regulatory regime.

Sir Franklyn, meanwhile, said FTX’s collapse did not necessarily mean there were weaknesses or deficiencies in The Bahamas’ regulatory regime. “Sometimes businesses fail. The fact it’s a big business, so what?” he asserted. “They fail sometimes. Sometimes the chief executives, the leaders of companies, may act improperly, sometimes criminally. That doesn’t mean the system is flawed or anything like that,” he told Tribune Business.

“We can also tell the world this is not our first rodeo. We have done this before. I was the court-appointed liquidator for Commodore Computers in the early 1990s, which at one time was one of the world’s biggest names. The fact of the matter is that The Bahamas survived Commodore Computers. It was a New York Stock Exchange listed company, truly a global company when that matter came up as being settled in the courts of The Bahamas.

“We had dozens of attorneys, maybe hundreds, in the courts. The creditors committee of the US subsidiary came to The Bahamas, objected to The Bahamas being the centre for the liquidation. It’s the same issue here,” Sir Franklyn argued of FTX. “We got through that. Myself, Paul Adderley and the creditors committee, we were able to negotiate an agreement where the liquidation proceeded in both jurisdictions. The same problem here.

“When people come here they must see competent judges. They must see competence within the judiciary. That’s what they must see. They must see our regulators holding the line. They must see that in our attorneys in The Bahamas they are equal to those on Wall Street or Bay Street, Toronto. That’s what they must see. They must see competence.

“I’m not getting into the merits or demerits of the case, but they must see we act in accordance with our law. Let us defend our law. Let us defend our regulators. Let us defend our country. Let’s stop seeking cheap brownie points. The leader of the Opposition needs to stand up, stand up and defend this country. We must stand united.”

Acknowledging that The Bahamas should be concerned about reputational fall-out over the FTX implosion, Sir Franklyn said the country’s cause would be helped if there was “no difference” between the positions taken by the Government and Opposition over the saga.

“Those that happen to find themselves in Opposition to the Government of the day should be far more judicious, thoughtful and just conscious of where we are,” he blasted, accusing Mr Pintard of giving “aid and comfort” to international media assaults on The Bahamas’ integrity and regulatory regime through various comments made in interviews and at press conferences.

The Arawak Homes chairman, in particular, singled out the press conference given by Mr Pintard last Friday outside the Prime Minister’s Office, accusing him of engaging in “theatrics” and “gimmicks” in a bid to obtain a “headline story” for himself and FNM party chairman, Dr Duane Sands.

Sir Franklyn also suggested Mr Pintard and the FNM are trying to distance themselves from a regulatory regime headlined by the Digital Assets and Registered Exchanges (DARE) Act, which passed into law under the former Minnis administration in 2020, and which was lauded by former minister of state, Kwasi Thompson, prior to FTX’s stunning fall from grace.

Mr Pintard, though, rejected Sir Franklyn’s criticism of both himself and his party. He suggested that the Opposition had effectively been forced to do the Government’s job for it given the Prime Minister’s relative silence on the matter, which has threatened to allow “enemies of The Bahamas and competitors of The Bahamas to fill the vacuum with their own narrative and risk further damaging the reputation of The Bahamas”.

“We were quite measured in the comments that we made. Clearly he could not have sat and listened to the presentation in its entirety,” the Opposition leader said of Sir Franklyn. “He could have been more offended by some of the questions than if he had listened to the presentation in its entirety.... Sir Franklyn Wilson is off-base in his concerns. I sat that in the strongest terms.

“We were fighting for the reputation of our jurisdiction while the Government was quiet, holding their silence. What we said was the Prime Minister and the Government, through their silence for an extended period of time, given that the world’s attention is trained at our jurisdiction, has left a vacuum. We are duty-bound to protect our jurisdiction, and we have not done anything to seek to damage that. We have been aggressive in doing that when the Government was quiet.”